- Background

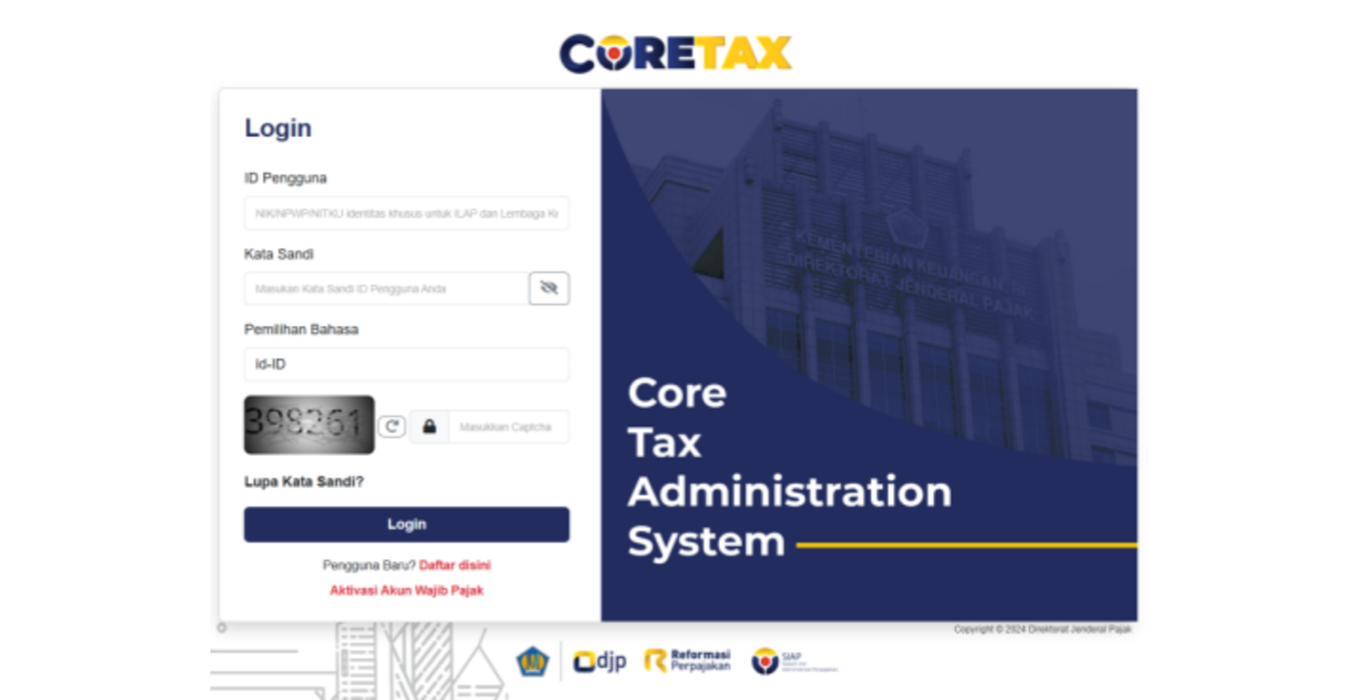

In order to modernize the Indonesian tax management system and achieve integrated management of the entire process from taxpayer registration, tax declaration, tax payment to tax audit and collection, the Indonesian government passed Government Regulation No. 40 of 2018 to launch a new tax management system, which was officially implemented nationwide from January 1, 2025. This system is called Coretax.

- Coretax Current Operation

Compared with the old tax system, the greatest advantage of the Coretax system is its high degree of integration. In the past, the processes of taxpayer registration, tax payment, declaration, tax audit and collection were scattered across multiple platforms. For example, taxpayer registration was carried out through the electronic registration system, income tax was paid through DJPonline, and if a value-added tax invoice was to be issued, it had to be done through the efaktur application. The entire process was extremely cumbersome. The Coretax system integrates these processes onto a single platform, aiming to simplify the tax declaration process.

However, after the official launch of Coretax at the beginning of 2025, many problems emerged during the system's operation, such as inability to log in, slow loading speed, and the inability to issue tax invoices (FP), which seriously affected the normal process of taxpayers fulfilling their tax obligations. These issues have sparked widespread controversy in Indonesia and prompted related enterprises to call on the government to introduce force majeure provisions to avoid imposing tax penalties on taxpayers due to system failures. However, the Directorate General of Taxation (DGT) currently states that it is still optimizing the Coretax system, and there are no force majeure provisions related to this issue that have been issued yet.

Therefore, given that the Coretax system is still not running stably at present, it is recommended that enterprises take certain preventive measures when filing tax returns to ensure that tax declarations comply with regulations and to reduce the risks caused by system failures. Enterprises can back up all tax data in advance, including declaration forms, invoices, and withholding vouchers, and keep records of successful submissions or screenshots of failures when submitting declarations for potential appeals later on. In addition, due to the current access difficulties and submission failures of the Coretax system, enterprises should also complete tax declarations 5-7 days in advance to avoid the risk of overdue due to system crashes before the deadline.

- Coretax as Future Trends

To address the issues in the operation of Coretax, on the 10th of this month, the Indonesian House of Representatives and the Directorate General of Taxation held a hearing and reached resolutions on the following matters:

- The House of Representatives has heard the report from the Directorate General of Taxation on the implementation of the Coretax system;

- The Directorate General of Taxation should temporarily activate the old tax system as an emergency plan;

- It must be ensured that the use of any tax system will not affect the tax revenue target of the 2025 national budget;

- A low-risk implementation plan for Coretax should be formulated, and strengthened service support for taxpayers should be provided;

- Tax delays caused by Coretax system failures should not be penalized;

- During the system optimization process, the Directorate General of Taxation must enhance cybersecurity measures;

- The Directorate General of Taxation is required to regularly report to the House of Representatives' Commission XI on the progress of Coretax-related work;

- The Directorate General of Taxation must respond in writing to the questions and opinions of the House of Representatives' Commission XI within 7 working days.

After the Coretax system encountered technical problems, the Indonesian Directorate General of Taxation has allowed the temporary activation of the old tax system as an emergency plan. Therefore, enterprises should closely monitor official announcements to confirm whether the old tax system is available in emergencies to avoid declaration delays. At the same time, if they fail to declare on time due to Coretax failures, enterprises should retain relevant evidence and promptly submit exception reports to the tax authorities to avoid unnecessary tax penalties due to system issues.

In addition, the launch of Coretax marks the acceleration of Indonesia's tax digitization process. In the future, enterprises should not only pay attention to strengthening cybersecurity but also regularly update their tax account passwords and be vigilant against phishing emails to ensure the security of their financial and tax management systems. Enterprises can also take this opportunity to optimize their internal tax management processes, review the division of declaration responsibilities, and adjust their ERP or financial software to adapt to the changes brought by Coretax. This will help them better adapt to the Coretax transition period and ensure the smooth progress of daily tax payments and declarations.